TL;DR

We propose the incorporation of a Cayman Islands Ownerless Foundation to serve as the legal wrapper for the Trevee DAO. This will enable the DAO to:

- Safely execute revenue-sharing mechanics with token holders

- Sign contracts with service providers (e.g., French and American development teams)

- Protect contributors from personal liability

- Build trust with potential investors and future partners

Terms:

- Cash: DAO covers incorporation, annual fees, legal service agreements, supervisor compensation, and director insurance (~$30–35k total)

- Token: Seasoned director role compensated with 0.5% of Trevee supply (~$20-30k at current prices) for the year

This is a strategic legal foundation for everything Trevee aims to build over the next few years.

Context

Trevee is evolving rapidly. Following the successful migration from Paladin and the introduction of real revenue-sharing mechanics, the DAO is entering a new phase of maturity. Proposals like PIP-28 through PIP-31 have clarified Trevee’s branding, technical direction, and tokenomics.

What’s missing is the legal infrastructure to match that operational progress.

Trevee now:

- Distributes protocol revenues to token holders

- Pays contributors and teams via the DAO

- Manages core IP, dashboards, and multi-chain deployments

These activities require a robust legal wrapper to avoid liability risks, enable compliant contracting, and open the door to future capital formation.

Proposal Scope

We recommend incorporating a Cayman Islands Ownerless Foundation, supported by a seasoned team of offshore professionals:

- A lead director with extensive experience in DAO structuring, governance execution, and regulatory interfacing

- An independent supervisor with a decade of crypto, fintech, and compliance background

Why a Foundation?

- No shareholders: fully aligns with decentralization

- DAO control: directors follow Snapshot votes or multisig-based governance

- Legal clarity: foundation can sign contracts, hold IP, manage fiat accounts

- Credibility: Cayman is recognized by exchanges, VCs, and regulators

This structure will:

- Allow Trevee to pay international contributors through enforceable agreements

- Allow Treeve to legally enforces contributor agreements (protects contributors and voters)

- Protect token holders and builders from liability

- Serve as a base for future token expansion, grant programs, or protocol upgrades

Why Cayman?

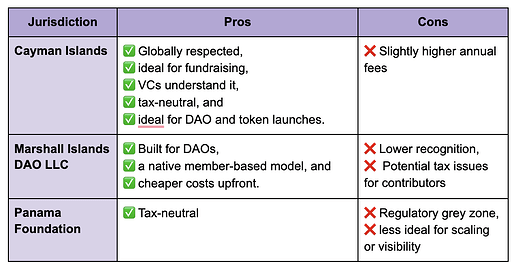

While we evaluated several offshore structures, Cayman emerged as the best fit.

Cost & Compensation Breakdown

Cash to be paid by the DAO:

| Item | Estimated Amount |

|---|---|

| Cayman Foundation Incorporation | $6,500–$12,400 (one-time) |

| Annual Government Fees | $5,000–$8,000 /year |

| Legal Agreements & Service Contracts | $5,000–10,000 |

| Supervisor Compensation | ~$7,500 /year |

| Offshore Insurance | ~$4,250 /year |

| Director Fee (paid in tokens) | $20-30k$ (paid in tokens, see below) |

Compensation for Director Role:

- 0.5% of Trevee total token supply (valued ~$20-30k at current prices)

About the Offshore Team

The proposed director and supervisor are seasoned Web3 entrepreneurs and offshore structuring specialists who have played pivotal roles in building and governing some of the largest crypto ecosystems to date.

-

The director is a former VC and founder with over a decade of experience in Web3 and digital asset infrastructure. He has led the creation of multiple DAO foundations across Cayman, BVI, Marshall Islands, and Panama, and actively serves as offshore director or FCEO to several protocols with $500M+ in market cap.

-

The supervisor is a crypto OG who launched the world’s first Bitcoin ATM network and led one of the first regulated exchange platforms to acquisition. He is currently CEO of a leading staking and DeFi infrastructure firm and brings unmatched operational insight into governance, token mechanics, and institutional-grade validator networks.

Together, they offer:

- End-to-end execution: legal, operational, and compliance

- Regulatory coverage: mind & management located offshore

- Long-term alignment: token-based comp ensures vested interest in Trevee’s growth

Next Steps

- Proposal passes

- Incorporation begins (approx. 30 days to complete)

- Legal service agreements signed with contributor teams

- Foundation operational by Q3 2025

Voting Options

For / Against / Abstain

- For

- Against

- Abstain

Frequently Asked Questions

Q: Why do we need this now?

Trevee has reached a level of maturity where legal infrastructure is not optional. Without it, the DAO cannot safely sign agreements, distribute revenue, or engage serious partners.

Q: Why Cayman over cheaper options?

We reviewed Marshall Islands and Panama. While cheaper, they lack the recognition, fundraising reputation, and legal clarity that Cayman provides — especially as Trevee scales.

Q: Is the 0.5% token allocation fair?

Yes. It aligns the director’s incentives long-term and is materially lower than what many DAOs offer (typically 1–2%). The operator is taking on legal liability and long-term commitment.